Discover the Hidden Gems: Undervalued Stocks with High Growth Potential!

时间:2023-09-07 00:32:10

导读:本文将介绍一些被低估的股票,它们具有高增长潜力,是投资者在股市中发现的隐藏宝石。我们将探讨这些股票的特点、投资机会以及如何发现它们。无论您是新手投资者还是经验丰富的交易员,这篇文章都将为您提供有价值的信息,帮助您在股市中找到潜在的高增长股票。

In the vast and ever-changing world of the stock market, there are hidden gems waiting to be discovered. These undervalued stocks possess high growth potential, making them attractive investment opportunities for those who can identify them. Whether you are a novice investor or an experienced trader, this article aims to provide valuable insights into finding these hidden gems and capitalizing on their potential.

Understanding Hidden Gems:

Hidden gems refer to stocks that are undervalued by the market, often overlooked or overshadowed by more popular stocks. These stocks may belong to companies with promising growth prospects, innovative products or services, or strong financial fundamentals. The key is to identify these undervalued stocks before the market catches on, allowing investors to benefit from their potential growth.

Identifying Undervalued Stocks:

Finding undervalued stocks requires a combination of research, analysis, and a keen eye for spotting opportunities. Here are some strategies to help you identify these hidden gems:

1. Fundamental Analysis: Evaluate the financial health and performance of a company by analyzing its balance sheet, income statement, and cash flow statement. Look for companies with strong fundamentals, such as low debt, consistent revenue growth, and healthy profit margins.

2. Industry Analysis: Research and understand the industry in which the company operates. Look for sectors with high growth potential or disruptive technologies that could drive future growth.

3. Valuation Metrics: Compare a company's valuation metrics, such as price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and price-to-book ratio (P/B), to industry peers. A lower valuation compared to its peers could indicate an undervalued stock.

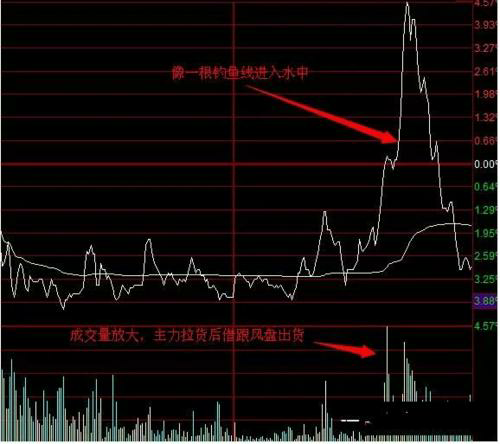

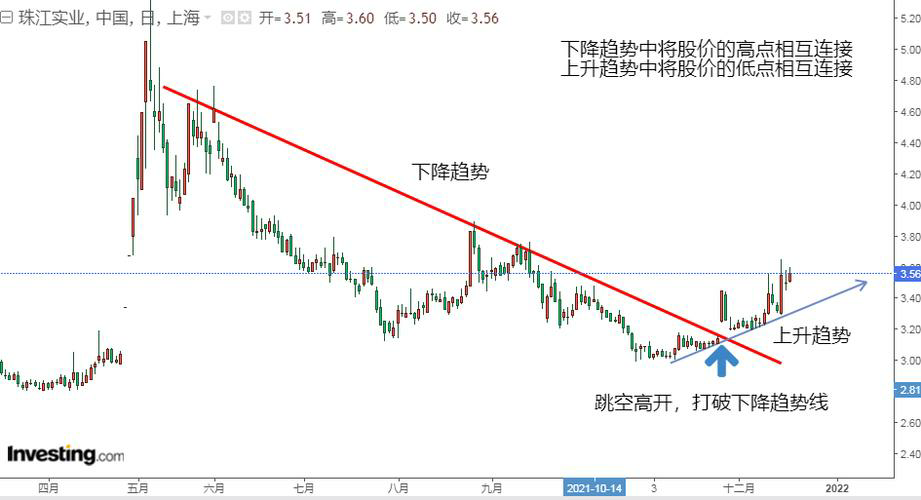

4. Technical Analysis: Study price charts and patterns to identify potential buying opportunities. Technical indicators, such as moving averages and relative strength index (RSI), can help determine if a stock is oversold or overbought.

Investment Strategies:

Once you have identified undervalued stocks with high growth potential, it's essential to develop a sound investment strategy. Here are a few strategies to consider:

1. Value Investing: Purchase undervalued stocks with the expectation that their true value will be recognized by the market over time. This strategy requires patience and a long-term investment horizon.

2. Growth Investing: Invest in companies with strong growth prospects, even if their current valuations may seem high. This strategy focuses on capitalizing on future earnings growth rather than current valuation.

3. Contrarian Investing: Take positions opposite to the prevailing market sentiment. This strategy involves buying undervalued stocks that are out of favor with the market but have the potential to rebound.

Conclusion:

Discovering hidden gems in the stock market can be a rewarding endeavor for investors. By identifying undervalued stocks with high growth potential, investors can potentially achieve significant returns on their investments. However, it's important to conduct thorough research, analyze the fundamentals, and develop a sound investment strategy before investing in these hidden gems. Remember, the stock market is inherently unpredictable, and risks are involved. Therefore, it's advisable to consult with a financial advisor or professional before making any investment decisions.

内容

-

Discover the Top Resilient Sto2023-09-07 03:32:10本文将介绍一些具有强大增长潜力的顶级弹性股票,这些股票在市场不确定性和挑战性环境中表现出色。通过分析这些股票的基本面和市...

Discover the Top Resilient Sto2023-09-07 03:32:10本文将介绍一些具有强大增长潜力的顶级弹性股票,这些股票在市场不确定性和挑战性环境中表现出色。通过分析这些股票的基本面和市... -

Hidden Gems: A Comprehensive L2023-09-05 12:14:10本文将为您提供一份全面的被严重低估的股票清单,这些股票被称为“Hidden Gems”(隐藏的宝石)。我们将探讨股票市场...

Hidden Gems: A Comprehensive L2023-09-05 12:14:10本文将为您提供一份全面的被严重低估的股票清单,这些股票被称为“Hidden Gems”(隐藏的宝石)。我们将探讨股票市场... -

市场庄家的数学智慧:芒格全面论述好股票的筛选方法2023-09-11 09:02:10本文将全面论述市场庄家芒格先生的数学智慧,以及他对好股票的筛选方法。通过深入分析芒格的投资理念和策略,我们将揭示他在选股...

市场庄家的数学智慧:芒格全面论述好股票的筛选方法2023-09-11 09:02:10本文将全面论述市场庄家芒格先生的数学智慧,以及他对好股票的筛选方法。通过深入分析芒格的投资理念和策略,我们将揭示他在选股... -

最具潜力的股票推荐:三只值得买入的热门股票2023-09-08 02:08:10本文将介绍三只最具潜力的热门股票,并提供详细的分析、预测和投资建议。通过对这些股票的基本面分析、行业前景评估和技术图表分...

最具潜力的股票推荐:三只值得买入的热门股票2023-09-08 02:08:10本文将介绍三只最具潜力的热门股票,并提供详细的分析、预测和投资建议。通过对这些股票的基本面分析、行业前景评估和技术图表分... -

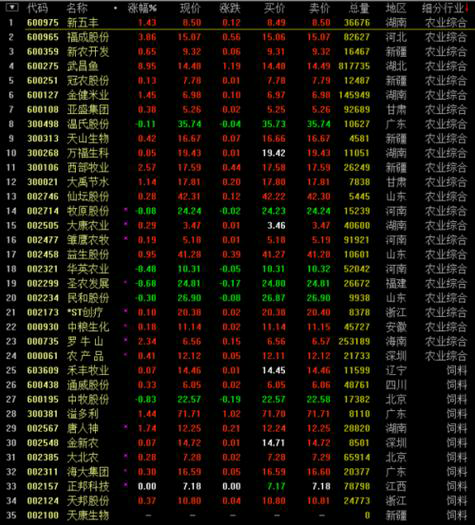

今日股市最新股票行情数据:涨停股、跌停股一览!2023-09-06 03:23:10本文将为您带来今日股市最新股票行情数据,重点关注涨停股和跌停股的情况。通过分析股票市场的涨停股和跌停股,帮助投资者了解股...

今日股市最新股票行情数据:涨停股、跌停股一览!2023-09-06 03:23:10本文将为您带来今日股市最新股票行情数据,重点关注涨停股和跌停股的情况。通过分析股票市场的涨停股和跌停股,帮助投资者了解股... -

掌握技术分析的基础知识,轻松把握市场走势!2023-09-05 02:13:10本文将介绍技术分析的基础知识,帮助读者轻松掌握市场走势。通过学习技术分析的基本原理、常用指标和图表模式,读者将能够更好地...

掌握技术分析的基础知识,轻松把握市场走势!2023-09-05 02:13:10本文将介绍技术分析的基础知识,帮助读者轻松掌握市场走势。通过学习技术分析的基本原理、常用指标和图表模式,读者将能够更好地...