Looking to Replenish Your Portfolio? These Types of Stocks Are Ideal Choices.

时间:2023-09-08 05:13:10

导读:本文将介绍一些理想的股票选择,以帮助您补充您的投资组合。了解这些股票类型将有助于您制定更好的投资策略,以在股市中取得成功。

Building and maintaining a well-diversified investment portfolio is crucial for long-term financial success. However, as market conditions change, it becomes necessary to replenish your portfolio with new stocks that have the potential for growth. In this article, we will explore some ideal stock choices that can help you replenish your portfolio and achieve success in the stock market. By understanding these types of stocks, you can develop a better investment strategy tailored to your financial goals.

1. Growth Stocks:

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks often reinvest their earnings into expanding their business, which can lead to substantial capital appreciation. Investing in growth stocks can be ideal for long-term investors who are willing to take on higher levels of risk in exchange for potentially higher returns.

2. Dividend Stocks:

Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are popular among income-focused investors who seek regular cash flow from their investments. Dividend stocks can provide stability to a portfolio, especially during market downturns, and can be an excellent choice for investors looking for a steady income stream.

3. Value Stocks:

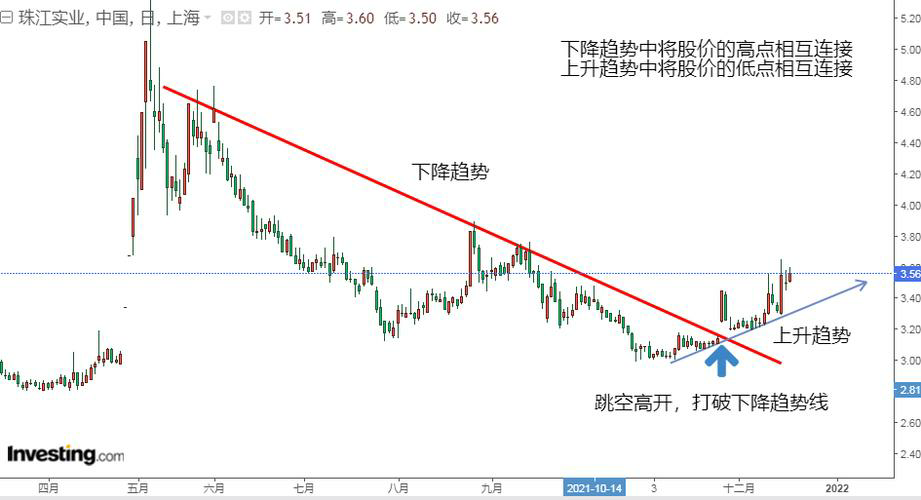

Value stocks are shares of companies that are considered undervalued by the market. These stocks often have lower price-to-earnings ratios and may be trading below their intrinsic value. Value investing involves identifying these undervalued stocks and holding them until the market recognizes their true worth. Investing in value stocks can be a prudent strategy for investors looking for long-term capital appreciation.

4. Blue-Chip Stocks:

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance. These stocks are considered to be relatively safe investments and are often included in the portfolios of conservative investors. Blue-chip stocks can provide stability and consistent returns, making them an ideal choice for investors looking for a low-risk option.

5. Technology Stocks:

Technology stocks represent shares of companies operating in the technology sector. These stocks can offer significant growth potential due to advancements in technology and innovation. Investing in technology stocks can be ideal for investors who believe in the long-term growth of the sector and are willing to take on higher levels of risk for potentially higher returns.

Conclusion:

Replenishing your investment portfolio with the right stocks is essential for long-term financial success. By considering the types of stocks mentioned above, such as growth stocks, dividend stocks, value stocks, blue-chip stocks, and technology stocks, you can develop a well-rounded investment strategy tailored to your financial goals. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

上一篇:北上资金大规模增持股票清单

内容

-

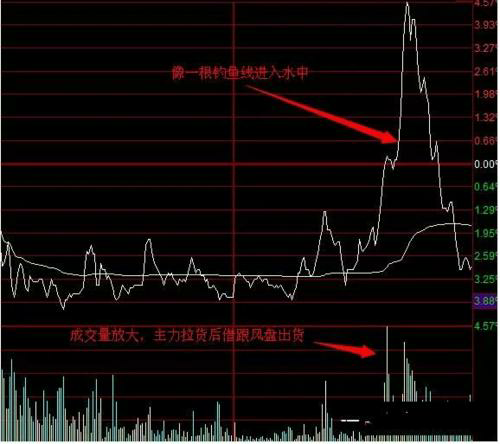

高增长牛股股票推荐_最新高增长牛股股票推荐信息2023-09-08 08:09:10本文将为您介绍最新的高增长牛股股票推荐信息,为投资者提供有价值的投资建议。我们将分析市场趋势,挖掘出具有高增长潜力的股票...

高增长牛股股票推荐_最新高增长牛股股票推荐信息2023-09-08 08:09:10本文将为您介绍最新的高增长牛股股票推荐信息,为投资者提供有价值的投资建议。我们将分析市场趋势,挖掘出具有高增长潜力的股票... -

-

重要机构持股数据揭示:数据中心行业备受关注!2023-09-06 17:26:10本文通过分析重要机构持股数据,揭示了数据中心行业备受关注的现象。文章从数据中心行业的发展背景、市场规模、重要机构持股情况...

重要机构持股数据揭示:数据中心行业备受关注!2023-09-06 17:26:10本文通过分析重要机构持股数据,揭示了数据中心行业备受关注的现象。文章从数据中心行业的发展背景、市场规模、重要机构持股情况... -

-

最具潜力的股票:或许能实现百倍涨幅!2023-09-07 06:24:10本文将揭示一些最具潜力的股票,这些股票有望实现百倍涨幅。通过分析股市投资的策略和风险,我们将为读者提供有关如何选择最具潜...

最具潜力的股票:或许能实现百倍涨幅!2023-09-07 06:24:10本文将揭示一些最具潜力的股票,这些股票有望实现百倍涨幅。通过分析股市投资的策略和风险,我们将为读者提供有关如何选择最具潜... -

中国股市: 机构重仓持有的低价股半年报大幅预增!2023-09-06 17:05:10本文将探讨中国股市中机构重仓持有的低价股在半年报中出现大幅预增的现象。通过分析机构投资者的投资策略和低价股的潜力,我们将...

中国股市: 机构重仓持有的低价股半年报大幅预增!2023-09-06 17:05:10本文将探讨中国股市中机构重仓持有的低价股在半年报中出现大幅预增的现象。通过分析机构投资者的投资策略和低价股的潜力,我们将...