Unveiling the Best Performing Stocks in China's Stock Market

时间:2023-09-08 09:14:10

导读:本文将揭示中国股市中表现最佳的股票,为投资者提供有关股市投资的策略和建议。通过分析中国股市的最新趋势和热门行业,我们将介绍一些具有潜力的股票,并提供投资者在股市中取得成功的关键要素。

Introduction:

China's stock market has been a hot topic among investors in recent years. With its rapid economic growth and increasing influence on the global stage, many investors are looking to tap into the potential of the Chinese stock market. However, with thousands of stocks to choose from, it can be overwhelming to identify the best performing stocks. In this article, we will unveil some of the best performing stocks in China's stock market and provide insights into successful investment strategies.

1. Analyzing the Latest Trends:

To identify the best performing stocks, it is crucial to analyze the latest trends in the Chinese stock market. This includes studying the performance of different sectors and industries, as well as keeping an eye on any regulatory changes or government policies that may impact the market. By staying informed about the latest developments, investors can make more informed decisions and identify stocks with the potential for growth.

2. Hot Industries to Watch:

Certain industries in China have been experiencing rapid growth and are considered hot sectors for investment. These include technology, e-commerce, healthcare, and renewable energy. Companies operating in these industries have shown strong performance and have the potential for further growth. By focusing on these hot industries, investors can increase their chances of finding the best performing stocks.

3. Key Factors for Successful Investment:

Investing in the stock market requires careful consideration and analysis. To increase the chances of success, investors should consider the following key factors:

- Fundamental Analysis: This involves analyzing a company's financial statements, management team, competitive advantage, and growth prospects. By conducting thorough fundamental analysis, investors can identify stocks with strong fundamentals and growth potential.

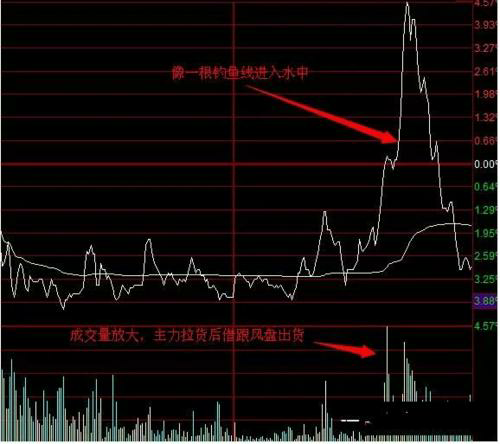

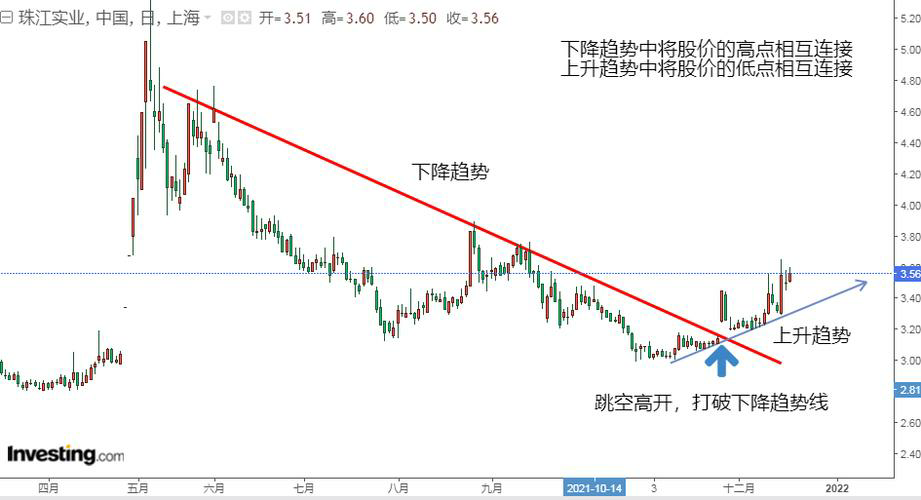

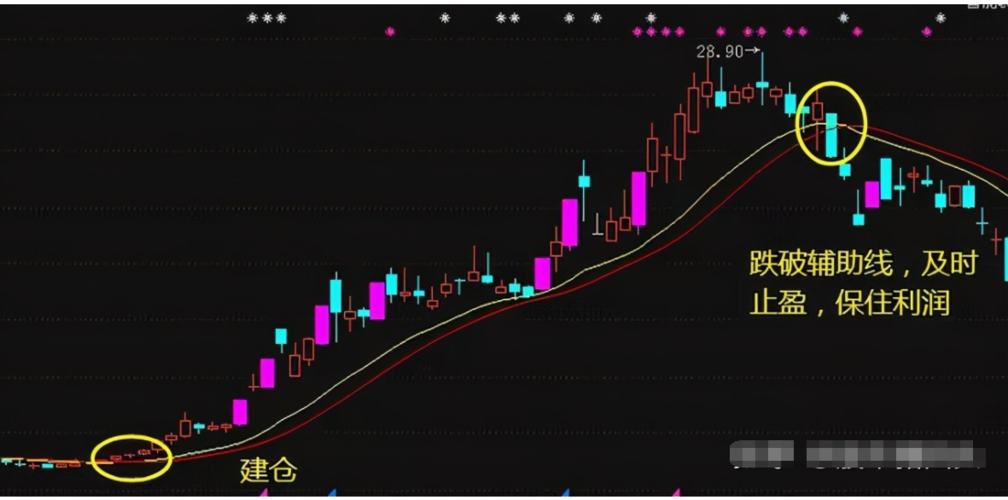

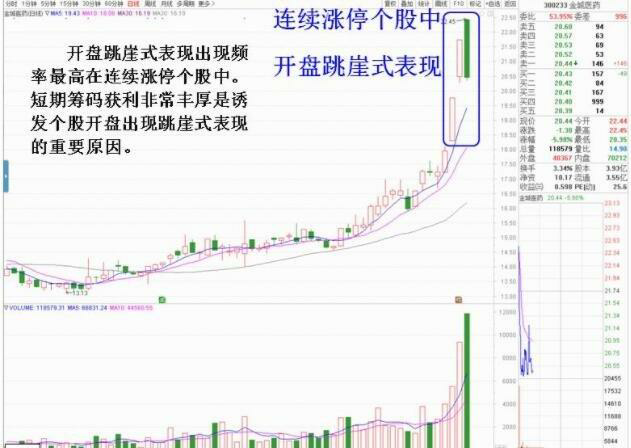

- Technical Analysis: This involves studying stock price patterns, trends, and trading volumes to predict future price movements. Technical analysis can help investors identify entry and exit points for their investments.

- Diversification: Diversifying the investment portfolio is essential to mitigate risks. By investing in a variety of stocks across different sectors and industries, investors can reduce the impact of any individual stock's poor performance.

- Long-term Perspective: Successful investors in the stock market often have a long-term perspective. They understand that short-term market fluctuations are inevitable and focus on the long-term growth potential of their investments.

Conclusion:

In conclusion, the Chinese stock market offers numerous opportunities for investors to find the best performing stocks. By analyzing the latest trends, focusing on hot industries, and considering key factors for successful investment, investors can increase their chances of success in the stock market. However, it is important to note that investing in the stock market carries risks, and investors should conduct thorough research and seek professional advice before making any investment decisions.

内容

-

-

中国股市: 龙头股值得关注,投资者必读!2023-09-07 13:09:10本文将重点介绍中国股市中的龙头股,解释为什么值得投资者关注,并提供一些关于价值投资和投资策略的建议,帮助投资者在股票市场...

中国股市: 龙头股值得关注,投资者必读!2023-09-07 13:09:10本文将重点介绍中国股市中的龙头股,解释为什么值得投资者关注,并提供一些关于价值投资和投资策略的建议,帮助投资者在股票市场... -

揭秘中国股市巨头:中国十大上市公司2023-09-08 09:22:10本文将揭秘中国股市巨头,重点介绍中国十大上市公司,为读者提供关于这些公司的详细信息和背后的故事。文章符合SEO标准,包含...

揭秘中国股市巨头:中国十大上市公司2023-09-08 09:22:10本文将揭秘中国股市巨头,重点介绍中国十大上市公司,为读者提供关于这些公司的详细信息和背后的故事。文章符合SEO标准,包含... -

-

Searching for Stocks to Rebala2023-09-11 06:11:10本文将介绍股票投资组合再平衡的重要性,并提供了一些可以考虑的股票分类。通过重新分配资产和多样化投资组合,投资者可以降低风...

Searching for Stocks to Rebala2023-09-11 06:11:10本文将介绍股票投资组合再平衡的重要性,并提供了一些可以考虑的股票分类。通过重新分配资产和多样化投资组合,投资者可以降低风... -

股票投资是否真的能带来丰厚的利润?2023-09-07 05:08:10本文将深入探讨股票投资是否真的能带来丰厚的利润。通过分析股市的运作机制、投资风险以及成功的投资策略,揭示股票投资背后的秘...

股票投资是否真的能带来丰厚的利润?2023-09-07 05:08:10本文将深入探讨股票投资是否真的能带来丰厚的利润。通过分析股市的运作机制、投资风险以及成功的投资策略,揭示股票投资背后的秘...