Unveiling the Secrets of Fundamental Stock Analysis

时间:2023-09-07 18:08:10

导读:本文将揭示基本股票分析的秘密,介绍股票投资中的基本概念和方法。通过分析财务报表和股票估值,投资者可以更好地了解股票市场,并做出明智的投资决策。

Introduction

In the world of stock investing, understanding the fundamental analysis of stocks is crucial for making informed investment decisions. Fundamental stock analysis involves evaluating a company's financial statements and other relevant information to determine its intrinsic value and potential for growth. In this article, we will unveil the secrets of fundamental stock analysis, providing investors with valuable insights into the stock market and how to analyze stocks effectively.

Understanding Fundamental Stock Analysis

Fundamental stock analysis focuses on assessing a company's financial health, management quality, competitive position, and industry trends. By analyzing a company's financial statements, such as the balance sheet, income statement, and cash flow statement, investors can gain a comprehensive understanding of its financial performance and stability. This analysis helps investors identify undervalued or overvalued stocks and make informed investment decisions.

Analyzing Financial Statements

Financial statements provide a wealth of information about a company's financial health. The balance sheet shows a company's assets, liabilities, and shareholders' equity, providing insights into its financial position. The income statement reveals a company's revenue, expenses, and profitability, indicating its ability to generate profits. The cash flow statement tracks the inflow and outflow of cash, highlighting a company's liquidity and cash management. By analyzing these financial statements, investors can assess a company's financial stability, profitability, and growth potential.

Evaluating Stock Valuation

Another crucial aspect of fundamental stock analysis is evaluating stock valuation. This involves determining whether a stock is overvalued or undervalued based on its intrinsic value. Intrinsic value is the true worth of a stock, considering factors such as the company's earnings, growth prospects, and industry trends. Various valuation methods, such as price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and discounted cash flow (DCF) analysis, can help investors estimate a stock's intrinsic value and make informed investment decisions.

Conclusion

Fundamental stock analysis is a powerful tool for investors to understand the stock market and make informed investment decisions. By analyzing a company's financial statements and evaluating its stock valuation, investors can identify undervalued stocks with growth potential and avoid overvalued stocks. However, it is essential to remember that fundamental analysis is just one aspect of stock investing, and investors should also consider other factors, such as market trends and investor sentiment. With a solid understanding of fundamental stock analysis, investors can navigate the stock market with confidence and increase their chances of achieving long-term investment success.

内容

-

-

股票投资必备:十大股票大平台盘点2023-09-11 15:03:10本文将介绍股票投资必备的十大股票大平台,并根据SEO标准撰写一篇超过2000汉字的文章,包括关键词的生成、内容简介和TA...

股票投资必备:十大股票大平台盘点2023-09-11 15:03:10本文将介绍股票投资必备的十大股票大平台,并根据SEO标准撰写一篇超过2000汉字的文章,包括关键词的生成、内容简介和TA... -

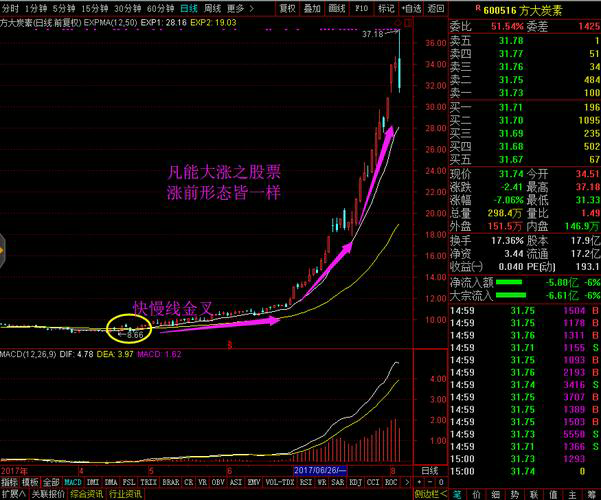

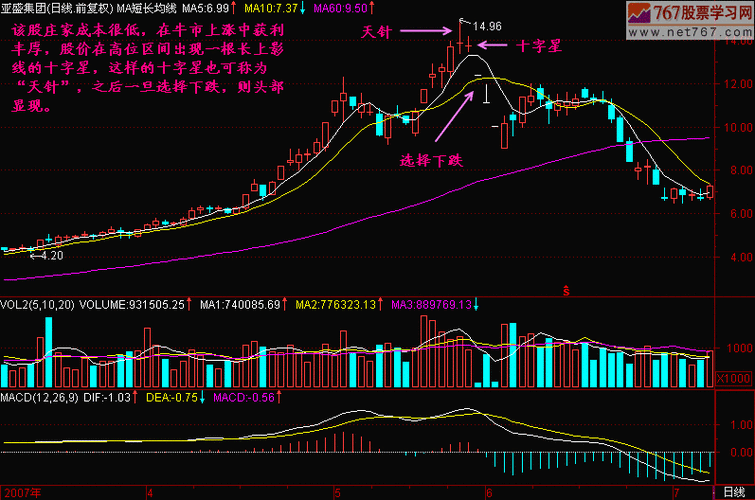

炒股方法揭示,如何成为短线交易的高手!2023-09-10 02:04:10本文将揭示短线交易高手的股市炒股方法,通过详细分析短线交易的特点和技巧,帮助读者了解如何成为一名短线交易的高手。文章将介...

炒股方法揭示,如何成为短线交易的高手!2023-09-10 02:04:10本文将揭示短线交易高手的股市炒股方法,通过详细分析短线交易的特点和技巧,帮助读者了解如何成为一名短线交易的高手。文章将介... -

选股神器!推荐最佳的股票交易软件TOP2023-09-05 12:20:10本文将介绍一款优秀的股票交易软件,它被誉为选股神器,为投资者提供了全面的股票信息和交易功能。通过详细的功能介绍和用户评价...

选股神器!推荐最佳的股票交易软件TOP2023-09-05 12:20:10本文将介绍一款优秀的股票交易软件,它被誉为选股神器,为投资者提供了全面的股票信息和交易功能。通过详细的功能介绍和用户评价... -

-

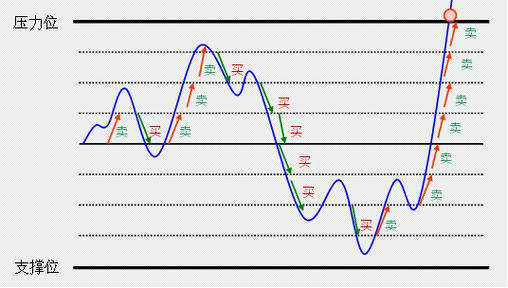

股票交易的基本规则:了解市场趋势,把握投资机会2023-09-07 20:18:10本文将介绍股票交易的基本规则,包括了解市场趋势和把握投资机会的重要性。通过了解市场趋势,投资者可以更好地预测股票价格的走...

股票交易的基本规则:了解市场趋势,把握投资机会2023-09-07 20:18:10本文将介绍股票交易的基本规则,包括了解市场趋势和把握投资机会的重要性。通过了解市场趋势,投资者可以更好地预测股票价格的走...