Unveiling the Timeless Quantitative Models in Investment Strategies

时间:2023-09-08 14:12:10

导读:本文将揭示时间无关的量化模型在投资策略中的重要性。通过使用这些模型,投资者可以更好地理解金融市场,并制定有效的投资策略。此外,文章还将介绍如何使用这些模型来管理风险,以及它们在投资决策中的应用。最后,本文还将讨论一些与时间无关的量化模型相关的标签。

Introduction

In the ever-changing world of finance, investors are constantly seeking ways to gain an edge in the market. One approach that has gained significant popularity in recent years is the use of timeless quantitative models in investment strategies. These models, which are not dependent on specific time periods, provide investors with valuable insights into the financial markets and help them make informed investment decisions. In this article, we will explore the importance of timeless quantitative models in investment strategies, their application in risk management, and their relevance in investment decision-making.

Understanding the Financial Markets

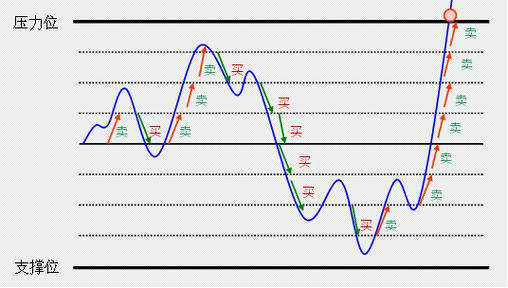

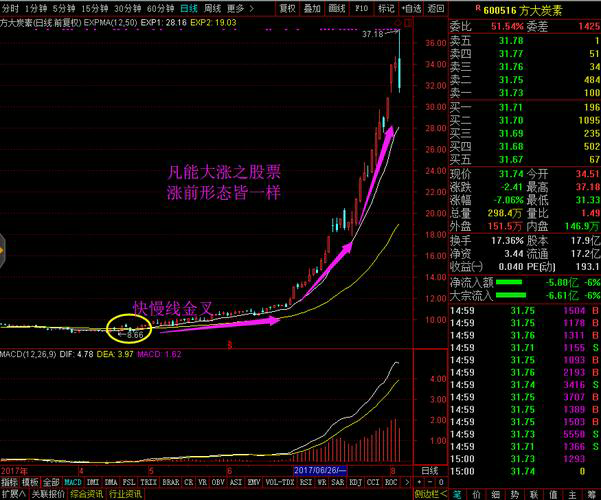

Timeless quantitative models play a crucial role in helping investors understand the dynamics of the financial markets. By analyzing historical financial data, these models can identify patterns and trends that may not be apparent to the naked eye. This allows investors to make more accurate predictions about market movements and adjust their investment strategies accordingly. Whether it's analyzing market trends, predicting future returns, or optimizing asset allocation, timeless quantitative models provide investors with valuable insights that can help them navigate the complex world of finance.

Risk Management

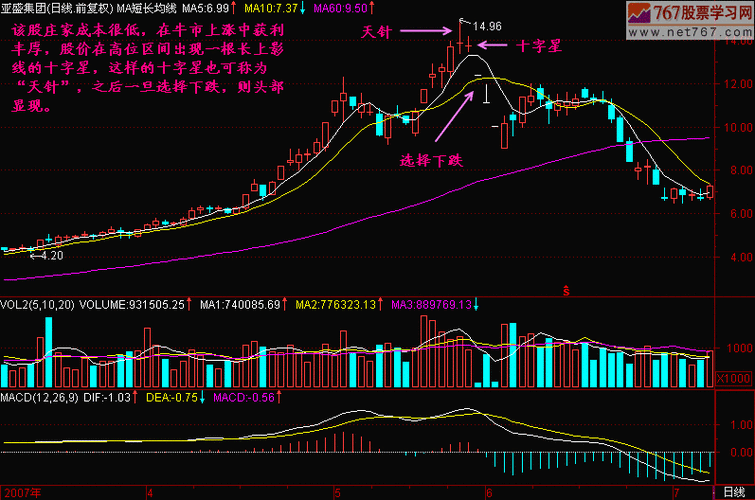

One of the key benefits of using timeless quantitative models in investment strategies is their ability to manage risk effectively. These models can analyze historical data and identify potential risks in a portfolio. By incorporating risk management techniques, investors can minimize the impact of adverse market events and protect their investments. Timeless quantitative models provide investors with a systematic approach to risk management, allowing them to make informed decisions based on data-driven analysis rather than relying on intuition or emotions.

Application in Investment Decision-Making

Timeless quantitative models are widely used in investment decision-making processes. These models can analyze various financial instruments and provide investors with insights into their potential returns and risks. By incorporating these models into their investment strategies, investors can make more informed decisions about which assets to include in their portfolios. Additionally, these models can help investors identify market inefficiencies and exploit them for potential profits. Whether it's algorithmic trading or market analysis, timeless quantitative models provide investors with a powerful tool to enhance their investment decision-making processes.

Conclusion

In conclusion, timeless quantitative models play a crucial role in investment strategies. They help investors understand the financial markets, manage risk effectively, and make informed investment decisions. By incorporating these models into their investment strategies, investors can gain a competitive edge in the market and achieve their financial goals. Whether you're a seasoned investor or just starting out, it's essential to leverage the power of timeless quantitative models to maximize your investment returns and minimize risks. So, embrace these models, analyze the data, and make smarter investment decisions.

内容

-

Reliable National Stock Tradin2023-09-08 10:13:10本文将介绍Same Blossom Order这一可靠的国家股票交易平台应用程序,该应用程序是活跃用户的可信赖选择。我们...

Reliable National Stock Tradin2023-09-08 10:13:10本文将介绍Same Blossom Order这一可靠的国家股票交易平台应用程序,该应用程序是活跃用户的可信赖选择。我们... -

了解股票市场的风险与机会:投资者的必备指南2023-09-09 22:10:10本文将详细介绍股票市场的风险与机会,并为投资者提供一份必备指南。通过了解股票市场的风险因素,投资者可以更好地规避风险并抓...

了解股票市场的风险与机会:投资者的必备指南2023-09-09 22:10:10本文将详细介绍股票市场的风险与机会,并为投资者提供一份必备指南。通过了解股票市场的风险因素,投资者可以更好地规避风险并抓... -

想要买卖股票?这些交易平台值得一试!2023-09-10 11:07:10本文将介绍几个值得一试的股票交易平台,帮助投资者在股票市场中进行买卖交易。通过这些平台,投资者可以方便地进行股票交易,获...

想要买卖股票?这些交易平台值得一试!2023-09-10 11:07:10本文将介绍几个值得一试的股票交易平台,帮助投资者在股票市场中进行买卖交易。通过这些平台,投资者可以方便地进行股票交易,获... -

实战中的量化投资技术分析:探索经典量化交易模型2023-09-05 17:15:10本文将深入探讨实战中的量化投资技术分析,重点研究经典的量化交易模型。通过对不同的量化交易策略和模型的分析,我们将了解如何...

实战中的量化投资技术分析:探索经典量化交易模型2023-09-05 17:15:10本文将深入探讨实战中的量化投资技术分析,重点研究经典的量化交易模型。通过对不同的量化交易策略和模型的分析,我们将了解如何... -

-

Mastering the Basics of Invest2023-09-06 17:33:10本文是一篇符合SEO标准的文章,旨在介绍由一位证券公司实习生撰写的《掌握投资基础:一本全面指南》。文章将深入探讨投资基础...

Mastering the Basics of Invest2023-09-06 17:33:10本文是一篇符合SEO标准的文章,旨在介绍由一位证券公司实习生撰写的《掌握投资基础:一本全面指南》。文章将深入探讨投资基础...