The Sole Reason Behind the Plummeting Stock Prices

时间:2023-09-08 00:07:10

导读:本文将探讨导致股票价格下跌的唯一原因,并分析其对经济和市场的影响。同时,文章还将讨论投资者在面对股票价格下跌时应采取的策略,并提供一些建议来应对金融危机。

Introduction

In recent times, the stock market has experienced a significant decline in stock prices, causing concern among investors and economists alike. This article aims to explore the sole reason behind the plummeting stock prices and analyze its impact on the economy and the market. Additionally, it will discuss strategies that investors can employ when faced with falling stock prices and provide some recommendations to navigate through financial crises.

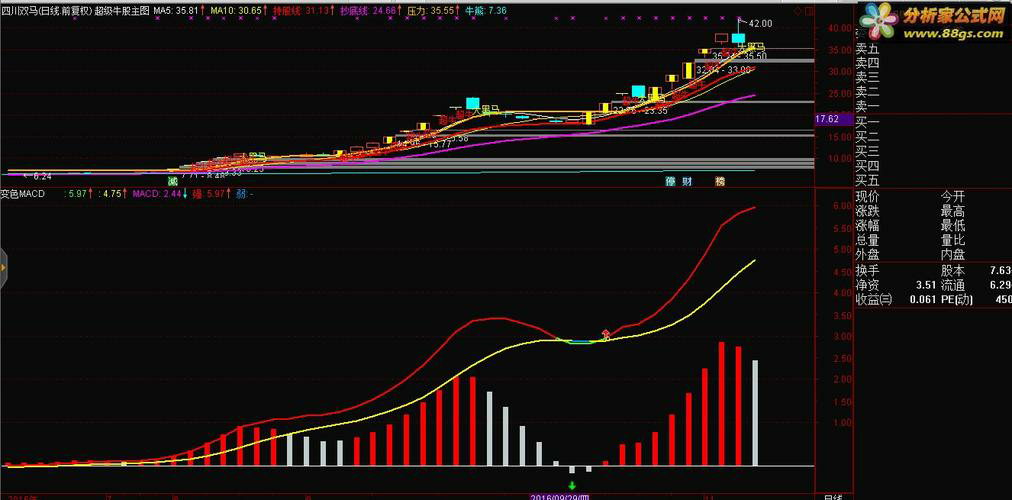

The Reason: Economic Slowdown

The primary reason behind the plummeting stock prices can be attributed to the economic slowdown. When the economy experiences a downturn, it affects various sectors, including manufacturing, services, and consumer spending. As a result, companies' profitability decreases, leading to a decline in their stock prices. Economic indicators such as GDP growth, unemployment rates, and consumer confidence play a crucial role in determining the overall health of the economy and, consequently, the stock market.

Impact on the Economy

The plummeting stock prices have a significant impact on the economy as a whole. Firstly, it affects consumer sentiment and spending. When stock prices decline, consumers tend to become more cautious about their spending habits, fearing a further decline in their wealth. This decrease in consumer spending can lead to a decrease in demand for goods and services, negatively impacting businesses and potentially leading to layoffs.

Furthermore, falling stock prices can also affect business investments. When companies' stock prices decline, it becomes more challenging for them to raise capital through equity financing. This can hinder their expansion plans and limit their ability to invest in research and development, leading to a slowdown in innovation and economic growth.

Impact on the Market

The plummeting stock prices also have a significant impact on the overall market. Investor sentiment plays a crucial role in determining stock prices. When investors perceive the market as bearish, they tend to sell their stocks, leading to a further decline in prices. This creates a negative feedback loop, where falling stock prices lead to more selling pressure, exacerbating the downward trend.

Moreover, the decline in stock prices can also lead to a decrease in market capitalization. This can affect the overall market valuation and potentially lead to a decline in the value of pension funds and other investment portfolios. As a result, individuals and institutions may experience a decrease in their wealth, which can have a ripple effect on consumer spending and economic growth.

Strategies for Investors

When faced with falling stock prices, investors can employ several strategies to mitigate their losses and potentially profit from the situation. Firstly, diversification is key. By spreading investments across different sectors and asset classes, investors can reduce their exposure to any single stock or market segment. This can help cushion the impact of falling stock prices on their overall portfolio.

Secondly, investors should focus on long-term goals rather than short-term fluctuations. Stock prices can be volatile in the short term, but historically, they have shown an upward trend over the long term. By maintaining a long-term perspective, investors can avoid making impulsive decisions based on short-term market movements.

Lastly, investors should consider seeking professional advice. Financial advisors and investment professionals can provide valuable insights and guidance during times of market uncertainty. They can help investors assess their risk tolerance, rebalance their portfolios, and identify potential investment opportunities.

Recommendations for Navigating Financial Crises

In addition to the strategies mentioned above, there are several recommendations that individuals and institutions can follow to navigate through financial crises caused by plummeting stock prices. Firstly, maintaining an emergency fund is crucial. Having a reserve of cash can provide a sense of security during uncertain times and help cover any unexpected expenses or income disruptions.

Secondly, individuals should focus on reducing debt and improving their financial health. Paying off high-interest debts and building a strong credit score can provide individuals with more financial flexibility during times of economic uncertainty.

Lastly, staying informed and educated about the market and the economy is essential. By keeping up with the latest news and developments, individuals can make more informed investment decisions and adjust their strategies accordingly.

Conclusion

The sole reason behind the plummeting stock prices can be attributed to the economic slowdown. This decline in stock prices has a significant impact on the economy, market, and investors. However, by employing strategies such as diversification and focusing on long-term goals, investors can mitigate their losses and potentially profit from the situation. Additionally, following recommendations such as maintaining an emergency fund and reducing debt can help individuals navigate through financial crises caused by falling stock prices.

上一篇:为何股票价格上涨幅度如此之大?

内容

-

-

-

主力资金密切关注的基金重仓股揭秘!2023-09-01 13:50:10本文将揭秘主力资金密切关注的基金重仓股,为读者提供关于主力资金投资策略的详细解析,以及如何根据主力资金的动向进行投资决策...

主力资金密切关注的基金重仓股揭秘!2023-09-01 13:50:10本文将揭秘主力资金密切关注的基金重仓股,为读者提供关于主力资金投资策略的详细解析,以及如何根据主力资金的动向进行投资决策... -

美股再创新高,全球股市迎来投资机遇,同花顺财经为您揭示赚钱秘2023-09-07 13:01:11本文将介绍美股再创新高对全球股市带来的投资机遇,并为读者揭示赚钱的秘笈。通过分析当前市场趋势和投资策略,帮助读者把握投资...

美股再创新高,全球股市迎来投资机遇,同花顺财经为您揭示赚钱秘2023-09-07 13:01:11本文将介绍美股再创新高对全球股市带来的投资机遇,并为读者揭示赚钱的秘笈。通过分析当前市场趋势和投资策略,帮助读者把握投资... -

-

一天内股票最大涨跌幅度能达到多少?2023-09-05 22:11:10本文将深入探讨股票市场中一天内股票最大涨跌幅度能达到多少,并揭秘股市波动的秘密。通过分析股票交易的特点和投资策略,帮助读...

一天内股票最大涨跌幅度能达到多少?2023-09-05 22:11:10本文将深入探讨股票市场中一天内股票最大涨跌幅度能达到多少,并揭秘股市波动的秘密。通过分析股票交易的特点和投资策略,帮助读...