Investment Recommendations: Opportunities to Diversify Your Portfolio

时间:2023-09-08 17:07:10

导读:本文将为您提供一些建议,帮助您多元化投资组合,以降低风险并提高回报。我们将介绍几种投资机会,以及如何在不同资产类别中进行分散投资。通过采取适当的风险管理策略,您可以在不同市场条件下实现稳定的投资回报。

Introduction

Diversifying your investment portfolio is crucial for managing risk and maximizing returns. By spreading your investments across different asset classes, you can reduce the impact of market volatility and increase the likelihood of achieving stable long-term returns. In this article, we will provide you with investment recommendations and opportunities to diversify your portfolio effectively.

1. Stocks and Bonds

Stocks and bonds are two fundamental asset classes that should be included in any well-diversified portfolio. Stocks offer the potential for high returns but come with higher risks. Bonds, on the other hand, provide stability and income through fixed interest payments. By combining stocks and bonds in your portfolio, you can balance risk and return.

2. Real Estate Investment Trusts (REITs)

Investing in real estate can be expensive and time-consuming. However, Real Estate Investment Trusts (REITs) offer an excellent opportunity to gain exposure to the real estate market without the hassle of directly owning properties. REITs are companies that own, operate, or finance income-generating real estate. By investing in REITs, you can diversify your portfolio with real estate assets and potentially earn regular income through dividends.

3. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, similar to individual stocks. ETFs offer diversification by tracking a specific index or sector. They provide exposure to a wide range of assets, such as stocks, bonds, commodities, or currencies. By investing in ETFs, you can easily diversify your portfolio across different asset classes and sectors.

4. International Investments

Investing internationally can provide additional diversification benefits. Different countries and regions may have different economic cycles and market conditions. By investing in international stocks or funds, you can reduce the risk associated with being too heavily concentrated in a single country or region. However, it is essential to research and understand the specific risks and regulations of each market before investing.

5. Alternative Investments

Alternative investments, such as hedge funds, private equity, or commodities, can offer unique opportunities for diversification. These investments often have low correlation with traditional asset classes, such as stocks and bonds, and can provide a hedge against market downturns. However, alternative investments are typically more complex and require a higher level of expertise and due diligence.

Conclusion

Diversifying your investment portfolio is crucial for managing risk and maximizing returns. By including a mix of stocks, bonds, real estate investment trusts, exchange-traded funds, international investments, and alternative investments, you can create a well-diversified portfolio that can withstand market fluctuations. Remember to regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Consult with a financial advisor to get personalized investment recommendations based on your specific circumstances.

内容

-

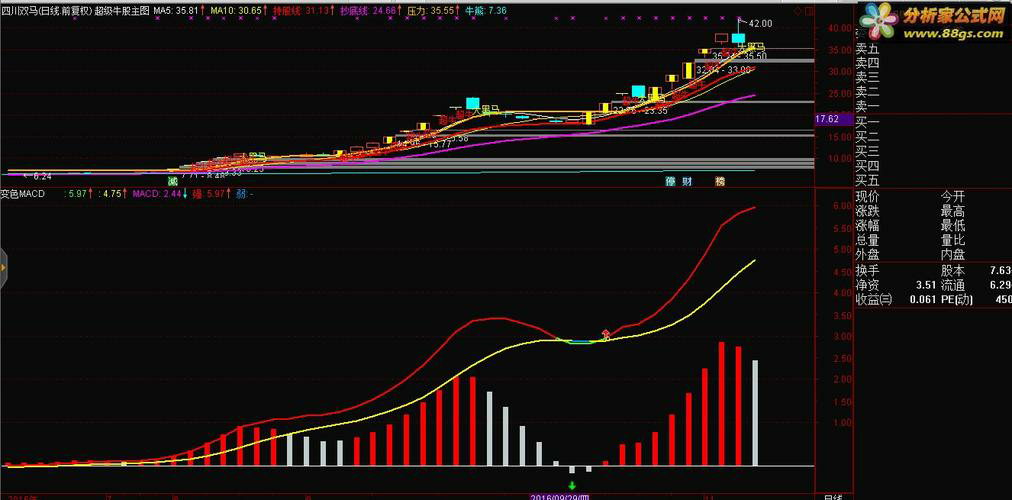

股票分析的重要工具:介绍常用的股票分析工具和指标2023-09-08 08:07:10本文详细介绍了股票分析中常用的工具和指标,包括技术分析和基本分析的方法。通过了解这些工具和指标,投资者可以更好地评估股票...

股票分析的重要工具:介绍常用的股票分析工具和指标2023-09-08 08:07:10本文详细介绍了股票分析中常用的工具和指标,包括技术分析和基本分析的方法。通过了解这些工具和指标,投资者可以更好地评估股票... -

股票投资基本分析:了解股票市场的基本知识2023-09-06 01:11:10本文将介绍股票投资的基本分析方法,帮助读者了解股票市场的基本知识。通过学习基本分析的概念、工具和技巧,读者将能够更好地理...

股票投资基本分析:了解股票市场的基本知识2023-09-06 01:11:10本文将介绍股票投资的基本分析方法,帮助读者了解股票市场的基本知识。通过学习基本分析的概念、工具和技巧,读者将能够更好地理... -

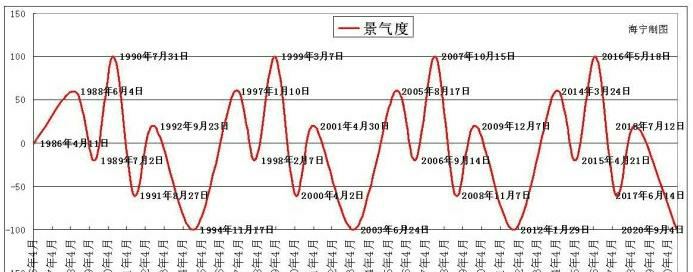

股票市场与主动股票基金:解析多层次资本市场的关系2023-09-03 13:08:10本文将深入探讨股票市场与主动股票基金之间的关系,重点分析它们在多层次资本市场中的作用和相互影响。文章将介绍股票市场的基本...

股票市场与主动股票基金:解析多层次资本市场的关系2023-09-03 13:08:10本文将深入探讨股票市场与主动股票基金之间的关系,重点分析它们在多层次资本市场中的作用和相互影响。文章将介绍股票市场的基本... -

我国五类资源严重稀缺,对外依赖程度超过2023-09-01 09:31:11本文将探讨我国五类资源的严重稀缺问题,以及对外依赖程度超过的影响。通过分析我国资源依赖的现状和原因,提出了一些解决方案,...

我国五类资源严重稀缺,对外依赖程度超过2023-09-01 09:31:11本文将探讨我国五类资源的严重稀缺问题,以及对外依赖程度超过的影响。通过分析我国资源依赖的现状和原因,提出了一些解决方案,... -

The Most Direct Reason for Sto2023-09-06 13:33:10本文将探讨股市下跌的最直接原因。股市下跌是指股票市场中股票价格普遍下跌的现象,通常与经济衰退、投资者恐慌、利率上升、贸易...

The Most Direct Reason for Sto2023-09-06 13:33:10本文将探讨股市下跌的最直接原因。股市下跌是指股票市场中股票价格普遍下跌的现象,通常与经济衰退、投资者恐慌、利率上升、贸易... -