Profit Forecasting Demystified: Techniques for Accurate Business Projections

时间:2023-09-11 20:01:10

导读:本文将介绍如何准确预测企业利润的技巧,帮助企业制定准确的商业投资计划和预测未来的盈利能力。通过了解利润预测的重要性以及使用各种技术和工具来进行准确预测,企业可以更好地规划和管理其财务状况。

Introduction

Profit forecasting plays a crucial role in the success of any business. It helps organizations make informed decisions, plan investments, and predict future profitability. Accurate profit projections enable businesses to allocate resources effectively and identify potential risks and opportunities. In this article, we will demystify the techniques for accurate profit forecasting, providing businesses with the tools and knowledge to make informed financial decisions.

Importance of Profit Forecasting

Profit forecasting is essential for businesses of all sizes and industries. It allows companies to set realistic financial goals, evaluate the feasibility of new projects, and assess the impact of various factors on their profitability. By forecasting profits, businesses can identify potential cash flow issues, plan for expansion or diversification, and make informed decisions about pricing, cost control, and resource allocation.

Techniques for Accurate Profit Forecasting

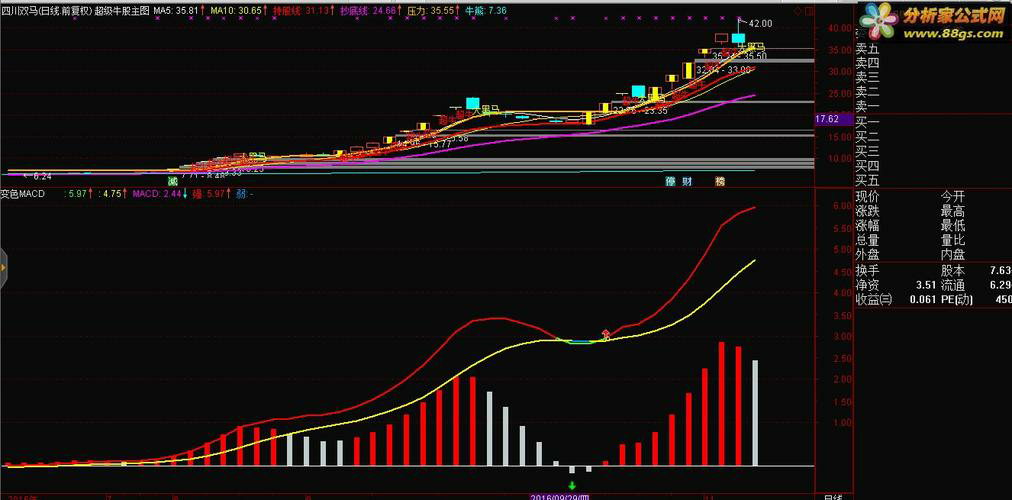

1. Historical Data Analysis: Analyzing past financial performance is a fundamental technique for profit forecasting. By examining historical data, businesses can identify trends, patterns, and seasonality that may impact future profitability. This analysis helps in setting realistic growth targets and understanding the factors that drive revenue and expenses.

2. Market Research and Analysis: Conducting thorough market research is crucial for accurate profit forecasting. Understanding market trends, customer behavior, and competitor analysis provides valuable insights into potential sales volumes, pricing strategies, and market share. By incorporating market research into profit forecasting, businesses can make more accurate predictions about future demand and revenue.

3. Scenario Analysis: Scenario analysis involves creating multiple scenarios based on different assumptions and variables. By considering various possibilities, businesses can assess the potential impact on profitability and make contingency plans. This technique helps in identifying potential risks and opportunities, allowing businesses to develop strategies to mitigate risks and capitalize on opportunities.

4. Financial Modeling: Financial modeling involves creating a mathematical representation of a business's financial situation. By using historical data, market trends, and other relevant factors, businesses can create models that simulate different scenarios and predict future profitability. Financial modeling helps in understanding the relationships between various financial variables and their impact on profit.

5. Expert Opinion and Industry Insights: Seeking expert opinions and insights from industry professionals can provide valuable input for profit forecasting. Industry experts can provide insights into market trends, regulatory changes, and other factors that may impact profitability. Incorporating expert opinions into profit forecasting adds another layer of accuracy and reliability.

Conclusion

Profit forecasting is a critical aspect of financial planning and management for businesses. By using accurate techniques such as historical data analysis, market research, scenario analysis, financial modeling, and expert opinions, businesses can make informed decisions and predict future profitability. Accurate profit projections enable businesses to allocate resources effectively, identify potential risks and opportunities, and plan for sustainable growth. By demystifying profit forecasting techniques, businesses can enhance their financial planning and management capabilities, leading to long-term success.

内容

-

Exploring the Stocks that Have2023-09-08 13:22:10本文将探讨在股票市场中经历持续上涨趋势的数据中心股票。通过对市场分析和投资策略的研究,我们将介绍一些具有潜力的数据中心股...

Exploring the Stocks that Have2023-09-08 13:22:10本文将探讨在股票市场中经历持续上涨趋势的数据中心股票。通过对市场分析和投资策略的研究,我们将介绍一些具有潜力的数据中心股... -

Stay Ahead of the Game with St2023-09-06 23:34:10本文将介绍StockQ国际股票市场指数,以及如何通过该指数来保持在股市中的领先地位。我们将探讨该指数的定义、计算方法以及...

Stay Ahead of the Game with St2023-09-06 23:34:10本文将介绍StockQ国际股票市场指数,以及如何通过该指数来保持在股市中的领先地位。我们将探讨该指数的定义、计算方法以及... -

股票分析的重要工具:介绍常用的股票分析工具和指标2023-09-08 08:07:10本文详细介绍了股票分析中常用的工具和指标,包括技术分析和基本分析的方法。通过了解这些工具和指标,投资者可以更好地评估股票...

股票分析的重要工具:介绍常用的股票分析工具和指标2023-09-08 08:07:10本文详细介绍了股票分析中常用的工具和指标,包括技术分析和基本分析的方法。通过了解这些工具和指标,投资者可以更好地评估股票... -

行业创新探索:中国经济网揭示新兴技术应用2023-09-08 19:09:10本文将以中国经济网为例,探讨新兴技术在行业创新中的应用。通过分析中国经济网的报道,揭示新兴技术在不同行业中的应用案例,并...

行业创新探索:中国经济网揭示新兴技术应用2023-09-08 19:09:10本文将以中国经济网为例,探讨新兴技术在行业创新中的应用。通过分析中国经济网的报道,揭示新兴技术在不同行业中的应用案例,并... -

经济形势分析中必备的统计指标有哪些?2023-09-10 11:09:10本文将介绍经济形势分析中必备的统计指标,包括经济增长率、通货膨胀率、失业率、财政赤字、国际贸易数据和货币供应量等。通过分...

经济形势分析中必备的统计指标有哪些?2023-09-10 11:09:10本文将介绍经济形势分析中必备的统计指标,包括经济增长率、通货膨胀率、失业率、财政赤字、国际贸易数据和货币供应量等。通过分... -