Cracking the Code: Can a Shared Market Perspective Lead to Accurate Predictions?

时间:2023-09-08 08:19:10

导读:本文探讨了共享市场视角是否能够帮助我们做出准确的市场预测。通过分析数据和研究投资策略,我们将探讨共享视角的潜力以及它对市场预测的影响。文章还将提供一些实用的技巧和建议,帮助读者更好地理解市场,并做出更准确的预测。

Market predictions play a crucial role in investment decisions. Investors are constantly seeking accurate forecasts to make informed choices and maximize their returns. In recent years, the concept of a shared market perspective has gained attention as a potential tool for accurate predictions. This article aims to explore the effectiveness of a shared market perspective in making accurate market predictions. By analyzing data and studying investment strategies, we will delve into the potential of a shared perspective and its impact on market predictions. Additionally, we will provide practical tips and advice to help readers better understand the market and make more accurate predictions.

The Power of a Shared Market Perspective:

A shared market perspective refers to the collective insights and knowledge of a group of individuals who actively participate in the market. This perspective takes into account various factors such as market trends, economic indicators, and investor sentiment. By pooling together different perspectives, a shared market perspective can potentially provide a more comprehensive understanding of the market, leading to more accurate predictions.

Data Analysis and Investment Strategies:

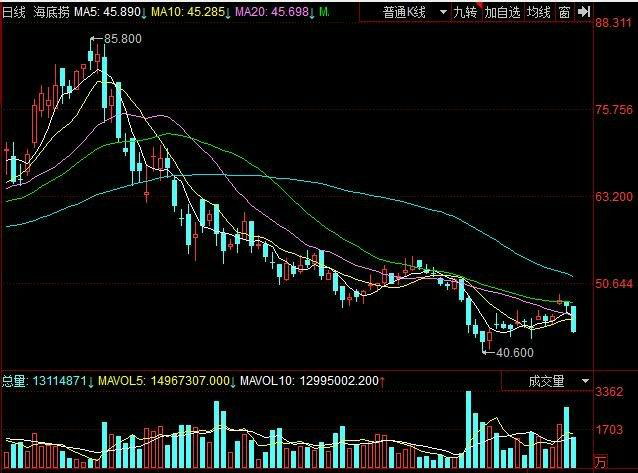

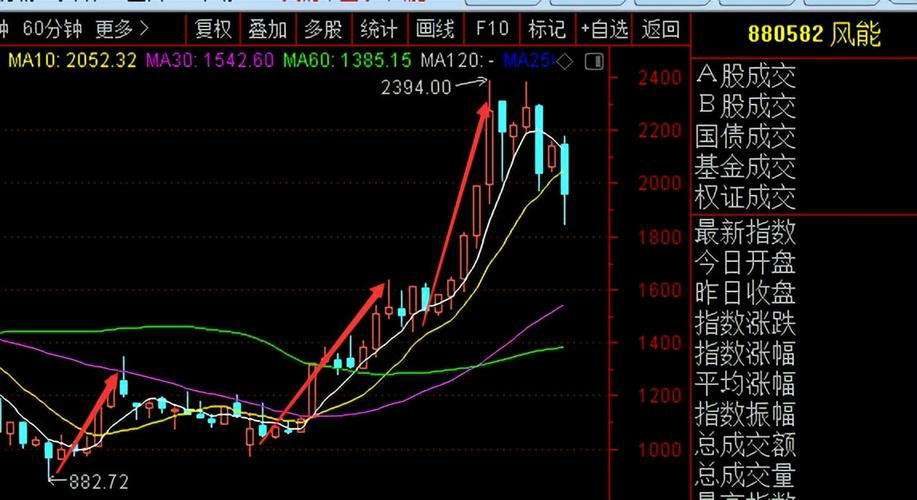

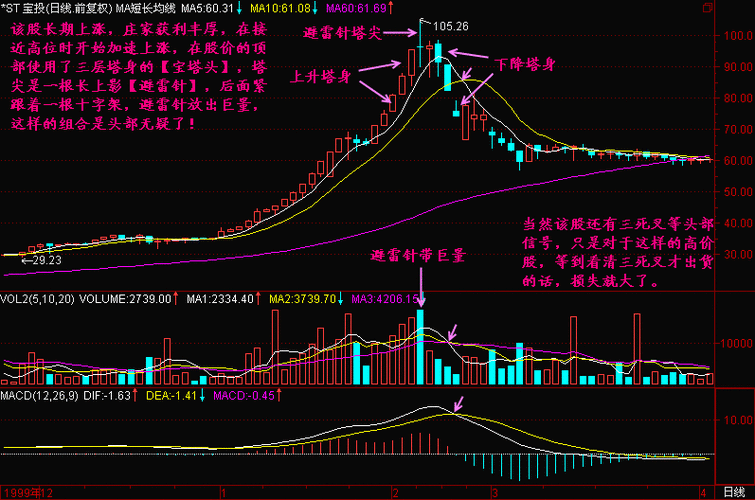

Data analysis is a crucial component of a shared market perspective. By analyzing historical data, market trends, and other relevant information, investors can identify patterns and make informed predictions. Additionally, studying different investment strategies can help investors gain insights into market behavior and make more accurate predictions. Strategies such as technical analysis, fundamental analysis, and quantitative analysis can all contribute to a shared market perspective and improve prediction accuracy.

Practical Tips for Accurate Predictions:

1. Stay updated with market news and trends: Keeping abreast of the latest market news and trends is essential for accurate predictions. This includes monitoring economic indicators, company announcements, and geopolitical events that may impact the market.

2. Diversify your information sources: Relying on a single source of information can limit your perspective. By diversifying your sources, you can gain a broader understanding of the market and make more accurate predictions.

3. Utilize technology and data analysis tools: Technology has revolutionized the way we analyze data. Utilizing data analysis tools and software can help investors identify patterns and trends, leading to more accurate predictions.

4. Learn from past mistakes: Analyzing past predictions and learning from mistakes can help investors refine their strategies and improve prediction accuracy. By understanding the reasons behind inaccurate predictions, investors can make adjustments and enhance their forecasting abilities.

Conclusion:

A shared market perspective has the potential to lead to more accurate market predictions. By analyzing data, studying investment strategies, and considering various perspectives, investors can gain a comprehensive understanding of the market and make informed predictions. However, it is important to note that market predictions are inherently uncertain, and no strategy can guarantee 100% accuracy. Nonetheless, by adopting a shared market perspective and following the practical tips provided, investors can improve their prediction accuracy and make more informed investment decisions.

内容

-

预测期货市场的黄金法则:三种技巧助你轻松预测价格变动!2023-09-11 09:03:10本文将介绍三种有效的技巧,帮助读者轻松预测期货市场的价格变动。通过遵循这些黄金法则,读者可以提高对期货市场的理解和预测能...

预测期货市场的黄金法则:三种技巧助你轻松预测价格变动!2023-09-11 09:03:10本文将介绍三种有效的技巧,帮助读者轻松预测期货市场的价格变动。通过遵循这些黄金法则,读者可以提高对期货市场的理解和预测能... -

股票行情走势图分析技巧:掌握趋势线的绘制方法2023-09-07 09:31:10本文将介绍股票行情走势图分析技巧中的趋势线绘制方法。通过掌握趋势线的绘制方法,投资者可以更准确地判断股票的走势,并做出相...

股票行情走势图分析技巧:掌握趋势线的绘制方法2023-09-07 09:31:10本文将介绍股票行情走势图分析技巧中的趋势线绘制方法。通过掌握趋势线的绘制方法,投资者可以更准确地判断股票的走势,并做出相... -

Mastering the Art of Economic2023-09-06 19:29:10本文将介绍《Mastering the Art of Economic Data Analysis: Seven Key...

Mastering the Art of Economic2023-09-06 19:29:10本文将介绍《Mastering the Art of Economic Data Analysis: Seven Key... -

-

宏观经济趋势预测:可持续发展成为企业竞争的关键2023-09-11 10:09:10本文将探讨宏观经济趋势预测中的可持续发展对企业竞争的重要性。通过分析当前的经济环境和趋势,以及企业在可持续发展方面的努力...

宏观经济趋势预测:可持续发展成为企业竞争的关键2023-09-11 10:09:10本文将探讨宏观经济趋势预测中的可持续发展对企业竞争的重要性。通过分析当前的经济环境和趋势,以及企业在可持续发展方面的努力... -

股票涨跌情况的主要预测指标有哪些?探索股市分析的关键要素2023-09-10 16:05:10本文将探讨股市分析的关键要素,包括技术分析和基本分析,并介绍股票涨跌情况的主要预测指标,帮助读者更好地理解和预测股市走势...

股票涨跌情况的主要预测指标有哪些?探索股市分析的关键要素2023-09-10 16:05:10本文将探讨股市分析的关键要素,包括技术分析和基本分析,并介绍股票涨跌情况的主要预测指标,帮助读者更好地理解和预测股市走势...