Can Everyone Predict the Market by Looking at the Same Chart?

时间:2023-09-04 14:12:10

导读:本文探讨了通过观察相同的图表来预测市场的可行性。我们将讨论技术分析的概念,以及它在市场预测中的应用。同时,我们还将探讨市场预测的准确性,并提供一些建议来提高预测的准确性。最后,我们将总结这个问题,并提供一些关于市场预测的思考。

Market prediction has always been a topic of great interest for investors and traders. The ability to accurately predict market movements can lead to significant profits. One popular method used for market prediction is technical analysis, which involves analyzing charts and patterns to identify potential trends. In this article, we will explore the feasibility of predicting the market by looking at the same chart and discuss the accuracy of such predictions.

Understanding Technical Analysis

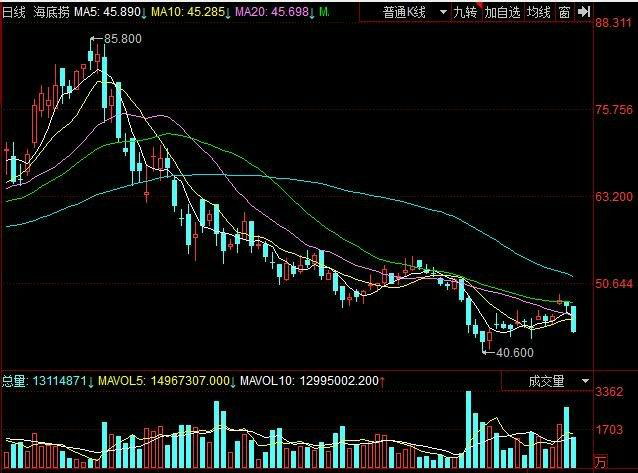

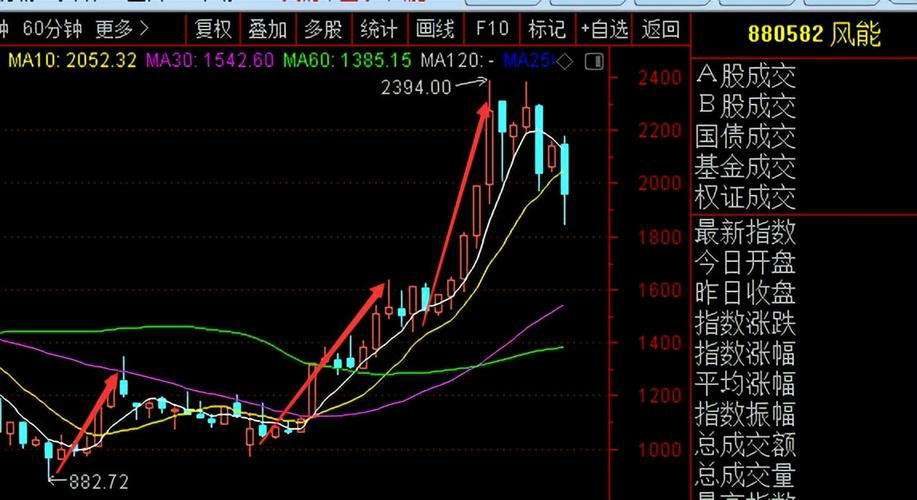

Technical analysis is a method of evaluating securities by analyzing statistical trends gathered from trading activity, such as price movement and volume. It is based on the belief that historical price and volume data can provide insights into future market trends. Technical analysts use various tools and indicators, such as moving averages, support and resistance levels, and chart patterns, to make predictions about future price movements.

The Role of Chart Analysis in Market Prediction

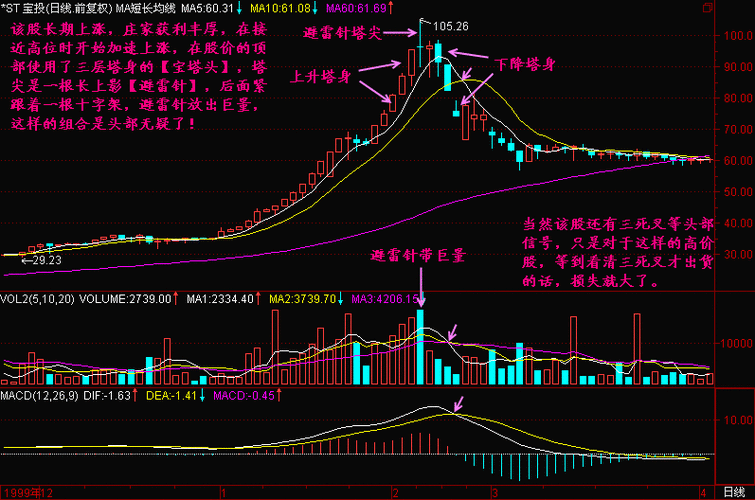

Chart analysis is a fundamental aspect of technical analysis. By examining charts, analysts can identify patterns and trends that may indicate future price movements. Common chart patterns include head and shoulders, double tops and bottoms, and triangles. These patterns can provide valuable information about potential reversals or continuations in market trends.

However, it is important to note that chart analysis alone may not be sufficient for accurate market prediction. Other factors, such as fundamental analysis, market sentiment, and economic indicators, should also be considered. Market prediction requires a comprehensive approach that combines multiple analysis techniques.

The Accuracy of Market Predictions

While technical analysis can be a useful tool for market prediction, it is not foolproof. The accuracy of predictions made solely based on chart analysis can vary greatly. Market conditions, unexpected events, and other factors can influence price movements and render chart patterns less reliable.

It is also worth mentioning that market prediction is inherently uncertain. The future is unpredictable, and no analysis technique can guarantee accurate predictions all the time. Even experienced traders and analysts can make incorrect predictions. Therefore, it is important to approach market prediction with caution and use it as a guide rather than a definitive source of information.

Improving Prediction Accuracy

Although market prediction can never be 100% accurate, there are ways to improve the accuracy of predictions. Here are some tips:

1. Use multiple analysis techniques: Combining different analysis techniques, such as technical analysis, fundamental analysis, and sentiment analysis, can provide a more comprehensive view of the market.

2. Stay informed: Keep up with the latest news, economic indicators, and market trends. Being aware of current events and developments can help in making more informed predictions.

3. Practice risk management: Implementing proper risk management strategies, such as setting stop-loss orders and diversifying investments, can help mitigate potential losses from incorrect predictions.

Conclusion

In conclusion, while looking at the same chart can provide valuable insights into market trends, it is not the sole determinant of accurate market prediction. Technical analysis, along with other analysis techniques, can be a useful tool for predicting market movements. However, it is important to remember that market prediction is inherently uncertain, and no method can guarantee 100% accuracy. By using a comprehensive approach, staying informed, and practicing risk management, investors and traders can improve their chances of making more accurate predictions.

内容

-

-

利用技术分析工具预测股市走势的步骤2023-09-06 11:02:10本文将介绍利用技术分析工具预测股市走势的步骤。通过使用各种技术指标和趋势分析工具,投资者可以更好地理解股市的走势,并做出...

利用技术分析工具预测股市走势的步骤2023-09-06 11:02:10本文将介绍利用技术分析工具预测股市走势的步骤。通过使用各种技术指标和趋势分析工具,投资者可以更好地理解股市的走势,并做出... -

全球百科:股票技术分析的终极指南2023-09-05 18:13:10本文将为您介绍全球百科关于股票技术分析的终极指南。我们将深入探讨股票技术分析的概念、方法和工具,帮助您了解如何利用技术分...

全球百科:股票技术分析的终极指南2023-09-05 18:13:10本文将为您介绍全球百科关于股票技术分析的终极指南。我们将深入探讨股票技术分析的概念、方法和工具,帮助您了解如何利用技术分... -

Exploring Market Research and2023-09-04 11:16:10本文将探讨市场研究和预测的重要性,并提供一份综合分析。通过遵循SEO标准,我们将为您提供一篇超过2000字的文章,涵盖关...

Exploring Market Research and2023-09-04 11:16:10本文将探讨市场研究和预测的重要性,并提供一份综合分析。通过遵循SEO标准,我们将为您提供一篇超过2000字的文章,涵盖关... -

如何利用机器学习算法进行精准宏观经济预测2023-09-10 05:06:10本文将介绍如何利用机器学习算法进行精准宏观经济预测。首先,我们将解释机器学习算法的基本原理和常用模型。然后,我们将探讨如...

如何利用机器学习算法进行精准宏观经济预测2023-09-10 05:06:10本文将介绍如何利用机器学习算法进行精准宏观经济预测。首先,我们将解释机器学习算法的基本原理和常用模型。然后,我们将探讨如... -